Most people treat money and wellness as completely separate parts of life. One belongs in spreadsheets, and the other in green smoothies in gym sessions. It’s what we’ve done with many separate and yet connected aspects of life. We’ve deconstructed them, giving them their own boxes to live in. While it seems logical, even necessary, the truth is, the deconstruction of life makes everything more difficult.

Money is a great example of this, though it is just one of many.

Your finances are actually part of the same system as your health and your habits. They are not separate compartments that you manage individually. They are part of one living, breathing whole called your life.

And the truth is, the way you spend money, even your smallest, most everyday choices, says something about who you are, what you value, and how you honor yourself. It also has the power to support your wellness or quietly drain it over time.

Why? Because it’s all interconnected. Thus, there is a correlation between how someone manages their finances and how they take care of their body.

The correlation between your finances and your health.

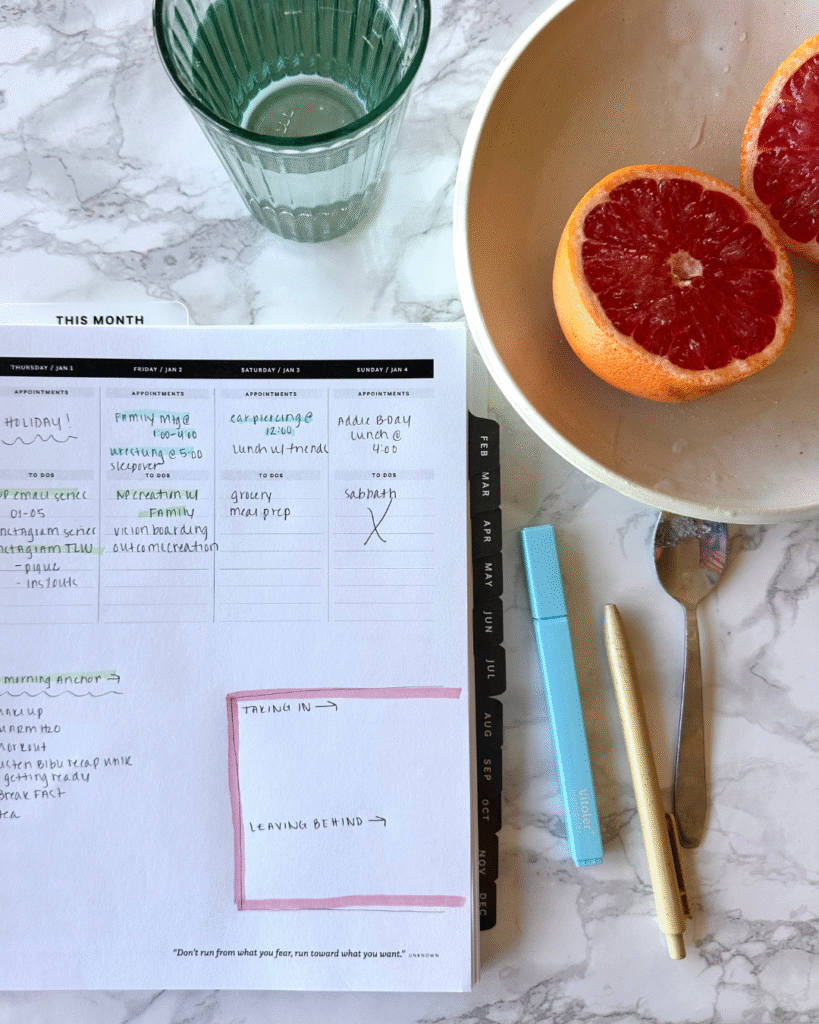

This is why wellness planning and a good wellness planner, like the Nourished Planner, are so important. You don’t need to be a financial expert, and you don’t need a “financial planner” to start seeing your money as part of your wellness practice. What you need is a system that helps you notice patterns, align with your values, and take intentional action. Not deconstructing your life into lists of rules, but rebuilding it as one cohesive, energized unit.

The Power of Seeing Your Life as a Single System

Think of your life like a plant. Your body is the soil, your energy is the water, your habits are sunlight, and your finances? They’re the nutrients in the soil. Each piece contributes to growth, but if one element is missing or toxic, the whole system struggles.

Most of us approach life in compartments. We budget money here, track workouts there, block out work hours separately, and hope that somehow it all adds up to a “healthy, fulfilling life.”

But compartmentalization misses the point: your life doesn’t work in independent departments. Your energy, your spending, your self-care, and your relationships all flow together.

When you intentionally use a wellness planner, you begin to see these connections. You notice how a stressful financial choice affects your sleep. How skipping a nourishing meal drains your mental focus and leads to poor decisions. And how carving out time for joy gives you the energy and clarity to make better choices in every area. Your planner becomes a place where all these threads meet and interact. Because they’re all interacting, even when you don’t see it.

Money as an Expression of You

Your money is an outlet of who you are. I don’t mean just in what you own, but how you move through life. Every dollar spent is a choice that aligns with your current way of life, whether conscious or unconscious.

- Buying coffee every morning from a place that delights you? That’s energy invested in joy.

- Buying a coffee every morning because you didn’t have time to make breakfast? That’s a scattered form of energy.

- Paying for a subscription you never use? That’s energy lost to not looking.

- Investing in an experience that nourishes your mind, body, or soul? That’s intentional happiness.

When you notice your spending through the lens of wellness, you can see how your financial decisions are often just an outlet or a mirror of your internal state. You’re using money to support the life you’re creating, or you’re spending money because you simply don’t have the energy to manage it.

When you begin to notice your spending through the lens of wellness, how your finances often mimic your health and vice versa, it becomes a more powerful driver for change.

Stop Deconstructing, Start Rebuilding

Many people approach wellness or finances with a deconstruction mindset: “I need to fix this, change that, eliminate everything.” That mindset is exhausting and rarely sustainable because it drains energy.

Instead of focusing on what isn’t working, focus on where you want to go and start making the connection that every action you take with your finances amplifies your health. Likewise, every decision about your health leads to cleaner financial decisions.

When you see them as connected, the burden of time becomes less. Managing your finances is no longer just about setting aside time to budget; it happens during your 30-minute walk.

I often return to the saying, “A rising tide lifts all ships.” Focusing on wholeness is the tide that rises all other aspects we tend to compartmentalize.

Rebuilding means:

- Seeing your body, mind, energy, and money as one unit.

- Choosing actions that support the whole system, not just a single metric.

- Planning for joy, freedom, and energy alongside tasks and bills.

- Treating every choice as a small investment in your life’s ecosystem.

It’s not about being perfect. It’s about creating alignment, noticing patterns, and responding consciously. Over time, these small shifts compound, creating health, energy, and financial wellness that are intertwined.

The Ripple Effect of Alignment

There is a massive ripple effect to reconstructing your life in wholeness. When you align your spending with your wellness:

- Stress drops because your actions reflect your values.

- Energy rises because you’re supporting your body and mind intentionally.

- Decision-making improves because you have the resourcing you need for clarity.

- Joy increases when your resources fund experiences and habits that feel good.

Not to mention, your wellness improves through better sleep, nutrition, and movement, as your financial decisions improve. In the process, management becomes easier because you reduce the impulse to spend and start investing in what matters rather than what doesn’t.

Financial stress has historically been a huge burden on humans. That is amplified greatly without the proper resourcing and capacity to shift your financial approach. That’s where the connection creates a ripple effect, making money and wellness allies rather than enemies.

How To Use Your Wellness Planner As A Guide To Financial Awareness

You might be thinking: “But I don’t want to turn my Nourished Planner into a budget book.” That’s not the point. You don’t need to track every transaction or memorize your account numbers. Instead, use your Nourished Planner to create awareness, intention, and alignment.

Here’s how:

1. Use It to Track Energy, Not Transactions

Similar to how you should plan your life, based on the energy you have available to engage in the tasks, rather than time alone. Tracking your finances and making financial decisions should be done when you’re well-resourced and have the energy to do so. The more capacity and energy you generate in your body, the better financial decisions and direction you will create.

Use your wellness planner as a tool to help build capacity and resource your body, not just by planning tasks, but by aligning your days for the non-negotiable energy fills. It’s not hoping for wellness, it’s creating it, building it, and sustaining it by planning your life around charging and resourcing your body.

2. Align Spending With Values

The second way a wellness planner (ahem, your Nourished Planner) can help you build a stronger financial structure is by helping you clarify your values. Most planners encourage planning without a clear understanding of what you are planning for or whether those plans align with who you are.

This is one of several reasons why burnout rates in our culture are so high. Most people don’t know who they are or what they want, leaving them planning for a life they don’t actually care to live.

But when you’re clear on your values and outcomes, you can align your life, plans, and daily actions with them, helping you make progress toward your desired direction. And with that comes a deep form of satisfaction.

3. Plan for Joy and Self-Care

Joy is one of the leading energy fillers and capacity builders of the human body. This is why all forms of joy and even play are becoming a major topic in our world. Joy matters, and that’s why you should schedule your joy just like you schedule your work. Ask yourself, what brings you joy and makes it a non-negotiable in your life.

Let your wellness planner be the bridge between intention and action.

Financially, this works too. When you begin to see your spending as a way to fund your energy, growth, and fun. One intentional coffee outing, a class, or even a weekly walk in the park is a small investment in your life, and your bank account starts reflecting what matters most.

4. Reflect Weekly (and Budget After Reflection)

It’s hard to know how to budget or the way to budget appropriately without knowing where you are and what is working and what isn’t. Before you budget, reflect.

Ask yourself:

- What fueled me this week?

- What drained me?

- Where did my money support or contradict my outcomes and values?

- How can I realign my financial decisions next week?

Does your morning coffee shop run align with your values and outcomes? Is that money well spent? Do your food purchases make you feel energized and well? Is that subscription bringing you joy and aligning with where you want to go?

This isn’t a matter of what is healthy or unhealthy, right or wrong. It’s really just acknowledging what is working or not working for you, at least in this season. That doesn’t mean it’s forever, but right now, how can you align your wellness actions and finances to move you toward your desired outcomes?

Actionable Steps to Integrate Your Money into Your Nourished Planner

Here are a few steps to align your financial and wellness goals and create a sense of wholeness.

- Identify Your Values: Write your top 3–5 life values in your planner.

- Track Feelings Around Spending: Note how purchases make you feel. No judgment. Just awareness.

- Plan Energy + Joy Investments: Schedule one small experience each week that fuels you. Treat it like a meeting with yourself.

- Weekly Reflection: Ask: “Where did my money and my wellness align? Where did they conflict?”

- Adjust Monthly: Revisit your values, your energy, and your spending patterns. Make small intentional tweaks.

Over time, this becomes a system of living fully, where money serves life, not the other way around.

Closing motivation:

Your life is not a collection of compartments. It is a living ecosystem where your health, energy, habits, and even your finances flow together. Using a wellness planner doesn’t just help you organize your day. It gives you a lens to see your life as a cohesive whole, notice patterns, and make intentional shifts.

When you start seeing money as part of your wellness plan, not something separate, you open a new possibility: you can create a life that’s aligned, energized, joyful, and intentional.

You don’t wait for the perfect body, perfect bank account, or perfect day. You take action now. And you choose to invest in yourself because your energy, choices, and alignment matter most.

And that is the essence of a life well lived.

Invest in a wellness planner and start building wholeness. Shop the Nourished Planners here!